At present, the national implementation of the national fourth-stage emission standards, the implementation of the fifth-stage emission standards in key areas, and the upcoming implementation of the national five-emission standards, the national six emission standards are gradually approaching, so that automotive companies must take measures to reduce emissions, the main domestic EGR (Exhaust Gas Recirculation System), DOC (Oxidation Catalytic Purifier), POC (Pellet Oxidation Purifier), SCR (Urea Injection System), and DPF (Particle Tractor) are all required to be monitored in real time using exhaust temperature sensors. High temperature sensors have become the focus of research.

Recently, GEP Research released the “Global and China High Temperature Sensor Industry Development Report” to conduct in-depth analysis and research on the global and Chinese high temperature sensor market and core component thin film platinum thermal resistance.

According to the report, the global demand for high temperature sensors in 2016 is 230 million, and the market size is 20.155 billion yuan. With the upgrade of emission standards, GEP Research expects the global demand for high temperature sensors by 2020 and The market size will reach 350 million and 310.42 billion yuan respectively.

According to the type of engine fuel, the market demand and market size of global diesel vehicle high temperature sensors in 2016 were 110 million and 9.804 billion yuan respectively, and it is expected to reach 100 million and 8.977 billion yuan by 2020 respectively; 2016 global gasoline vehicles The market demand and market size of high-temperature sensors are 120 million and 10.351 billion yuan respectively. The German-Chinese environmental consulting is expected to reach 250 million and 22.065 billion yuan by 2020 respectively.

According to the service market, the global demand for high-temperature sensor OEMs in 2016 was 111 million, and the market size was 9.856 billion. With the increase in the number of countries implementing the Euro-6 standard, the GEP Research report is expected to reach 2020. The global market demand for high-temperature sensor OEMs and market size will reach 200 million and 17.776 billion yuan respectively.

In 2016, the global market demand for high-temperature sensors was 116 million, and the market size was 10.3 billion yuan. With the upgrade of emission standards, the report predicts that the global demand for high-temperature sensors and market size will reach 149 million and 13.27 billion respectively by 2020. yuan.

In 2016, China’s high-temperature sensor market demand is 7.39 million, and the market size is 660 million yuan. It is expected that the demand and market size of China’s high-temperature sensor market will reach 8.67 million and 790 million yuan respectively in 2017; upgrade from Guowu to Guoliu Standards, GEP Research expects that the demand for high-temperature sensors in China is expected to reach 88.852 million in 2020, and the market size will reach 8 billion yuan.

According to the type of engine fuel, the demand for high-temperature sensors for diesel vehicles in China in 2016 was 7.39 million, and the market size was 660 million yuan. After upgrading to China in 2020, GEP Research expects that the demand for high-temperature sensors and market size of diesel vehicles in China will reach 15.23 million and 1.35 billion yuan respectively in 2020. It is estimated that the market demand and market size of gasoline vehicle high temperature sensors in 2020 will be 74.439 million and 6.64 billion yuan respectively.

According to the service market, in terms of the OEM market, the demand and market size of China’s high-temperature sensor OEM market in 2016 were 5.512 million and 490 million yuan respectively. After the upgrade of China’s five countries, the report is expected to reach the Chinese high-temperature sensor OEM market by 2020. Demand and market size reached 63.274 million and 5.63 billion yuan respectively;

After 2016, China’s high-temperature sensor service market demand and market size were 1,878,400 and 176 million yuan respectively; after the country’s fifth upgrade to the country, the report predicts that by 2020, China’s high-temperature sensor service market demand and market size will reach 256.78 million respectively. Only with 2.365 billion yuan;

The global high-temperature sensor manufacturers are mainly concentrated in Germany, the United States, Japan and other countries and regions. The industry market is mainly concentrated in foreign manufacturing companies such as Sensata, Continental, Denso DENSO, UST Sensor, Germany B + B.

According to the GEP Research report, as of the end of October 2017, there were 7,120 patents (including inventions, utility models and appearances) in China (according to the number of publication days). The patents in the field of temperature sensors in China mainly focus on the use of transmission, scattering or fluorescence changes in optical fibers. The components are non-linear resistors, support/fixing devices, and protection devices.

The vehicle high temperature sensor mainly focuses on the temperature range, measurement accuracy and response time of the indicator; the research and development focus and technical development direction of the vehicle high temperature sensor are: improving the structure of the high temperature sensor, reducing the manufacturing cost, improving the temperature detection accuracy, and improving the service life. etc.

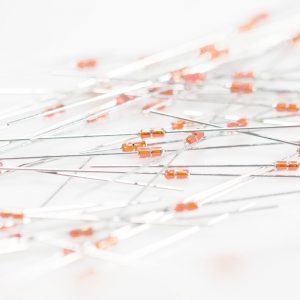

According to the “Global and China High Temperature Sensor Industry Development Report”, the current temperature measurement in high temperature and wide temperature areas mainly uses platinum resistance type temperature sensors, and thermocouples and high temperature type thermistors can also be used. From the perspective of research and production enterprises, there are two main technologies used in automotive high-temperature sensors: thin-film platinum thermal resistance technology and thermocouple technology. Among them, Continental Group’s high-temperature sensors use thermocouple technology, Sensata, Germany ust, Germany B + B and other use platinum resistance technology.

According to the “Global and China High Temperature Sensor Industry Development Report”, the average import price of the three automakers of Mahindra, Tata and BMW is about US$13/only. From the perspective of upstream key raw material prices, the German Heraeus Heraeus high-temperature product HM220 RTD export price is about 4 US dollars / piece, the average price of high temperature thin film platinum resistance components is about 25 RMB / piece.

In the vehicle emission reduction scheme, the exhaust gas temperature needs to be monitored, and the data is fed back to the ECU in real time. The ECU processes the exhaust gas according to the corresponding scheme to achieve the corresponding emission standard, thereby requiring real-time use of the exhaust gas temperature sensor. monitor. The upgrade of emission standards will bring market opportunities to the growth of high-temperature sensor market demand, which will bring new increments to the industry.

In terms of risks, it is necessary to be alert to the possibility that new energy vehicles will occupy market share and policies restrict diesel vehicles, which will lead to a shrinking market for diesel vehicles, thus affecting the growth of demand for high-temperature sensors.